Hey there, neighbor! If you're diving into the world of property taxes in Spartanburg, SC, you've come to the right place. Whether you're a first-time homeowner, a seasoned real estate investor, or just trying to make sense of your tax bill, the Spartanburg SC Tax Assessor is your go-to resource. Let's break it down together and figure out how this whole property tax thing works, shall we?

Property taxes can feel like a maze sometimes, but don't sweat it. Understanding how the Spartanburg SC Tax Assessor operates is key to managing your finances and ensuring you're not overpaying—or worse, missing out on valuable deductions. Stick with me, and we'll navigate this together.

Now, let's get one thing straight: the tax assessor isn't your enemy. They're actually here to help ensure that everyone pays their fair share based on accurate property valuations. Sounds simple enough, right? Well, buckle up, because there's more to it than meets the eye.

Read also:Who Is Rivers Married To Unveiling The Love Story Behind The Spotlight

What Exactly Does the Spartanburg SC Tax Assessor Do?

Alright, let's start with the basics. The Spartanburg SC Tax Assessor is the local government office responsible for assessing the value of all properties within Spartanburg County. This includes residential homes, commercial buildings, vacant land—you name it. Their job is to determine the fair market value of each property so that property taxes can be calculated fairly and accurately.

Here's how it works: once the assessor determines your property's value, they send that info over to the county treasurer's office, which then calculates your actual tax bill based on the current millage rates. It's a team effort, but the assessor plays a crucial role in setting the foundation.

Oh, and by the way, if you're wondering what "millage rates" mean, don't worry—we'll cover that later. For now, just know that it's basically the tax rate applied to your property's assessed value.

Key Responsibilities of the Tax Assessor

Let's dive deeper into what the tax assessor actually does day-to-day. Here's a quick rundown:

- Property Valuation: The assessor evaluates your property's worth using various methods, including market analysis and cost approach.

- Updating Records: They keep track of changes to your property, like renovations or new constructions, to ensure the valuation stays current.

- Handling Appeals: If you disagree with your property's assessed value, the assessor's office is where you go to file an appeal.

- Providing Information: The assessor's office is a treasure trove of data for homeowners, real estate agents, and investors looking to understand property values in Spartanburg.

See? They're kind of like the gatekeepers of property tax knowledge. Pretty cool, right?

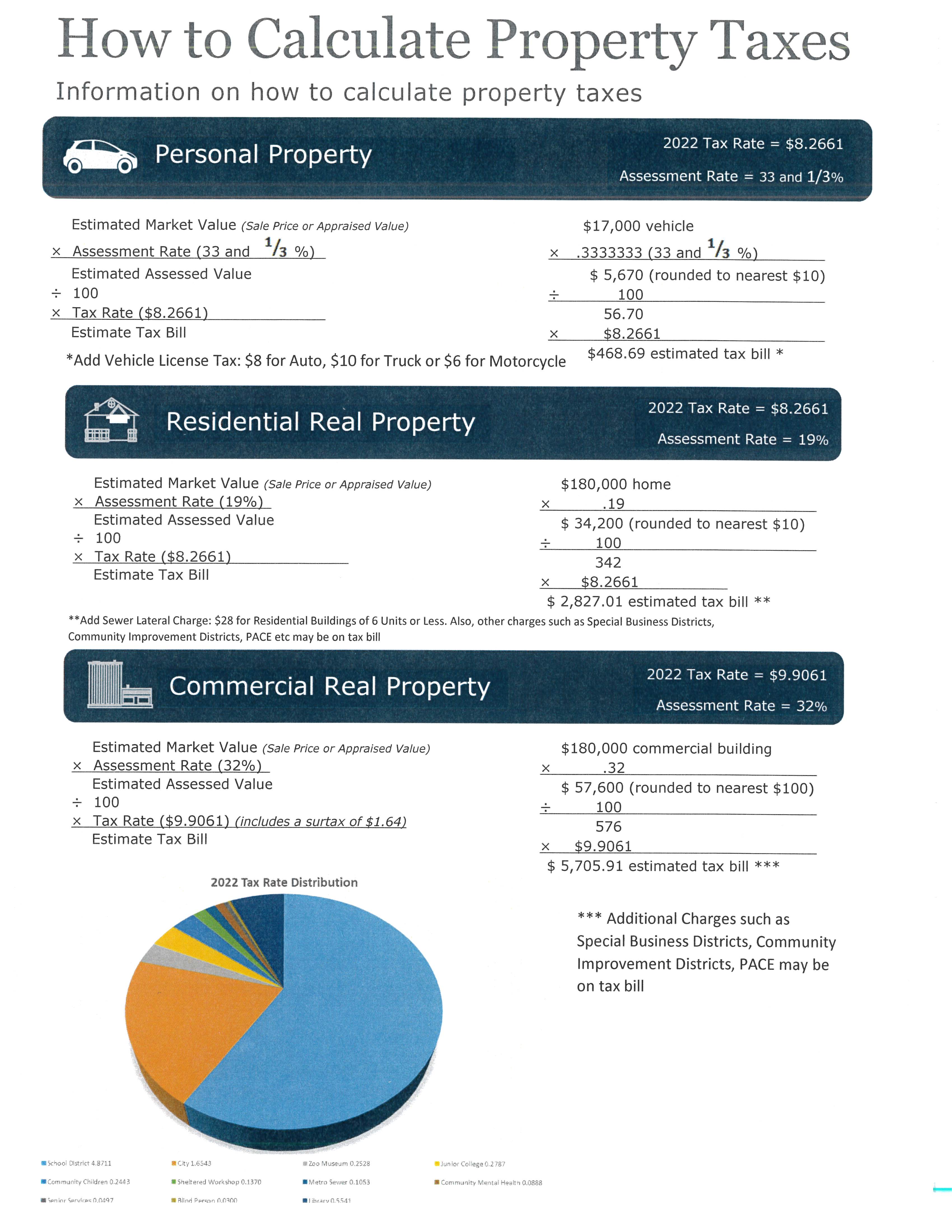

How Property Taxes Are Calculated in Spartanburg SC

Now that we know what the tax assessor does, let's talk about how property taxes are calculated. It's not rocket science, but there are a few steps involved. Stick with me here.

Read also:Jaysom Tatum Wife The Untold Story Behind The Scenes

First, the tax assessor determines your property's assessed value. In South Carolina, this is typically 4% of the fair market value for owner-occupied homes and 6% for other types of property. Once they've got that number, they multiply it by the current millage rate to figure out your tax bill.

For example, let's say your home is valued at $200,000. If you're an owner-occupant, the assessed value would be $8,000 (4% of $200,000). If the millage rate is 150 mills, your tax bill would be $1,200 (150 mills x $8,000).

Understanding Millage Rates

Millage rates are basically the tax rates set by local governments. In Spartanburg, these rates can vary depending on the type of property and its location within the county. For instance, residential properties might have a different millage rate than commercial properties.

It's worth noting that millage rates can change from year to year based on budget needs and other factors. That's why it's a good idea to keep an eye on them and stay informed.

Why Accurate Property Valuation Matters

Here's the deal: accurate property valuation is super important for a couple of reasons. First, it ensures that everyone is paying their fair share of property taxes. Second, it helps maintain the integrity of the local tax system, which funds essential services like schools, public safety, and infrastructure.

But what happens if your property is overvalued or undervalued? Well, that's where things can get tricky. If your property is overvalued, you could end up paying more in taxes than you should. On the flip side, if it's undervalued, you might not be contributing your fair share to the community.

That's why it's so important to review your property's assessed value carefully and speak up if you think it's inaccurate.

How to Challenge Your Property's Assessed Value

If you believe your property's assessed value is off, you have the right to appeal it. Here's how:

- Gather Evidence: Collect data to support your claim, such as recent sales of similar properties in your area.

- File an Appeal: Submit your appeal to the Spartanburg SC Tax Assessor's office within the specified timeframe.

- Attend a Hearing: You may be required to present your case at a hearing, where a board will review your evidence and make a decision.

Pro tip: It's always a good idea to consult with a real estate professional or tax expert if you're unsure about how to proceed.

Common Misconceptions About Property Taxes in Spartanburg

There are a few myths floating around about property taxes in Spartanburg that I want to clear up. Let's tackle them one by one:

- Myth #1: Property taxes only affect homeowners. Nope! Commercial property owners and landlords are subject to property taxes too.

- Myth #2: Once you pay off your mortgage, your property taxes disappear. Wrong! Property taxes are separate from your mortgage and continue as long as you own the property.

- Myth #3: Property taxes never change. Uh, yeah, they do! Millage rates and property values can fluctuate, so your tax bill might too.

Now that we've busted those myths, let's move on to some more useful info.

Tips for Managing Property Taxes

Here are a few tips to help you manage your property taxes effectively:

- Stay Informed: Keep an eye on millage rates and any changes to tax laws that might affect you.

- Take Advantage of Exemptions: Some homeowners may qualify for property tax exemptions, such as homestead exemptions or senior citizen discounts.

- Plan Ahead: Budget for property taxes as part of your overall financial plan to avoid any unpleasant surprises.

By staying proactive, you can keep your property tax situation under control and avoid unnecessary headaches.

Resources for Spartanburg SC Taxpayers

Luckily, the Spartanburg SC Tax Assessor's office provides plenty of resources to help taxpayers understand and manage their property taxes. Here are a few:

- Online Property Records: You can access your property's assessed value and tax history online through the assessor's website.

- FAQ Section: The website also features a helpful FAQ section that answers common questions about property taxes.

- Contact Information: Need to speak to someone directly? The assessor's office provides phone numbers and email addresses for reaching out with questions.

Don't be afraid to reach out if you have questions or concerns. The staff is there to help!

How to Stay Updated on Tax Changes

One of the best ways to stay on top of property tax changes is to sign up for updates from the Spartanburg SC Tax Assessor's office. They often send out newsletters or notifications about upcoming changes to millage rates or tax laws.

You can also follow local news sources or join community groups to stay informed about tax-related issues affecting Spartanburg residents.

Conclusion: Take Control of Your Property Taxes

Alright, folks, that's a wrap on our deep dive into Spartanburg SC property taxes. By now, you should have a solid understanding of how the tax assessor operates, how property taxes are calculated, and how to manage your tax bill effectively.

Remember, knowledge is power when it comes to property taxes. Stay informed, ask questions, and don't hesitate to challenge your assessed value if you think it's inaccurate. Your wallet will thank you!

Oh, and before you go, why not drop a comment below and share your thoughts on property taxes in Spartanburg? Or better yet, share this article with a friend who could benefit from the info. Let's keep the conversation going!

Table of Contents

- What Exactly Does the Spartanburg SC Tax Assessor Do?

- How Property Taxes Are Calculated in Spartanburg SC

- Why Accurate Property Valuation Matters

- Common Misconceptions About Property Taxes in Spartanburg

- Resources for Spartanburg SC Taxpayers

- How to Stay Updated on Tax Changes

Thanks for sticking with me through this journey into the world of Spartanburg SC property taxes. Now go forth and conquer those tax bills like a pro!